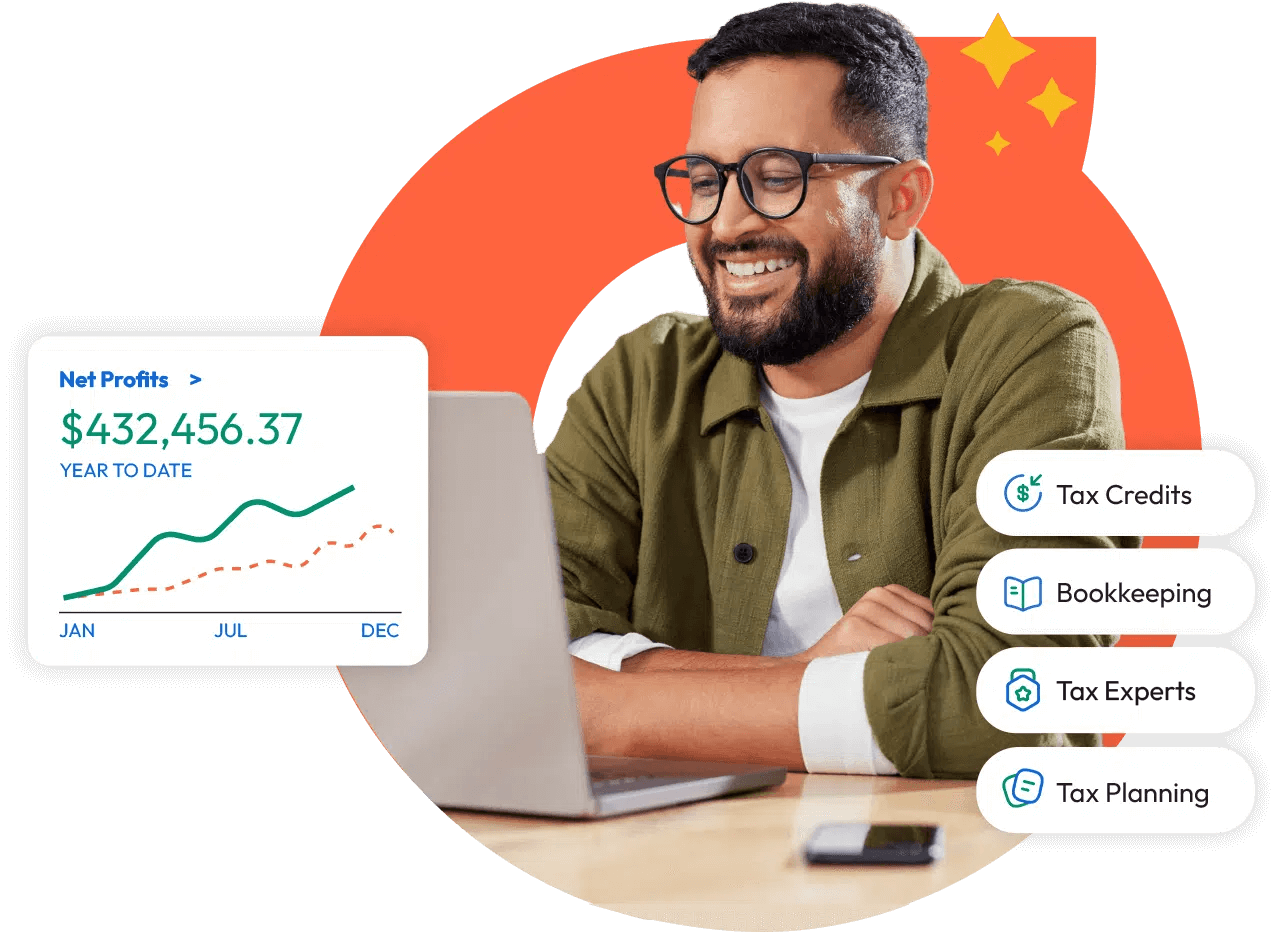

Our founders left top firms to level the playing field for small and medium-sized businesses.

Our custom-built software facilitates relationships with experienced experts,

so you can cover all your bases and see the big picture with Arvo’s enterprise-grade service.

so you can cover all your bases and see the big picture with Arvo’s enterprise-grade service.

R&D

The government wants to pay you for spending on research and development. Let them.

Bookkeeping

Get regular, reliable bookkeeping managed by real human experts.

Tax planning

Don’t just file. Know you’re capitalizing on every available opportunity.

WOTC

Hire disadvantaged job-seekers. Get paid. Win-win.

Reclaim your time. Grow your margins.

Every business needs clear, reliable financials, and expert insight—but between today’s CPA

shortage and AI rush, those things are becoming harder to find.

Too many tools?

We solve your problems, not multiply them.

Deadline madness?

We check in regularly throughout the year.

Automated out of sight?

We’ll answer the phone (or message) when you need us.

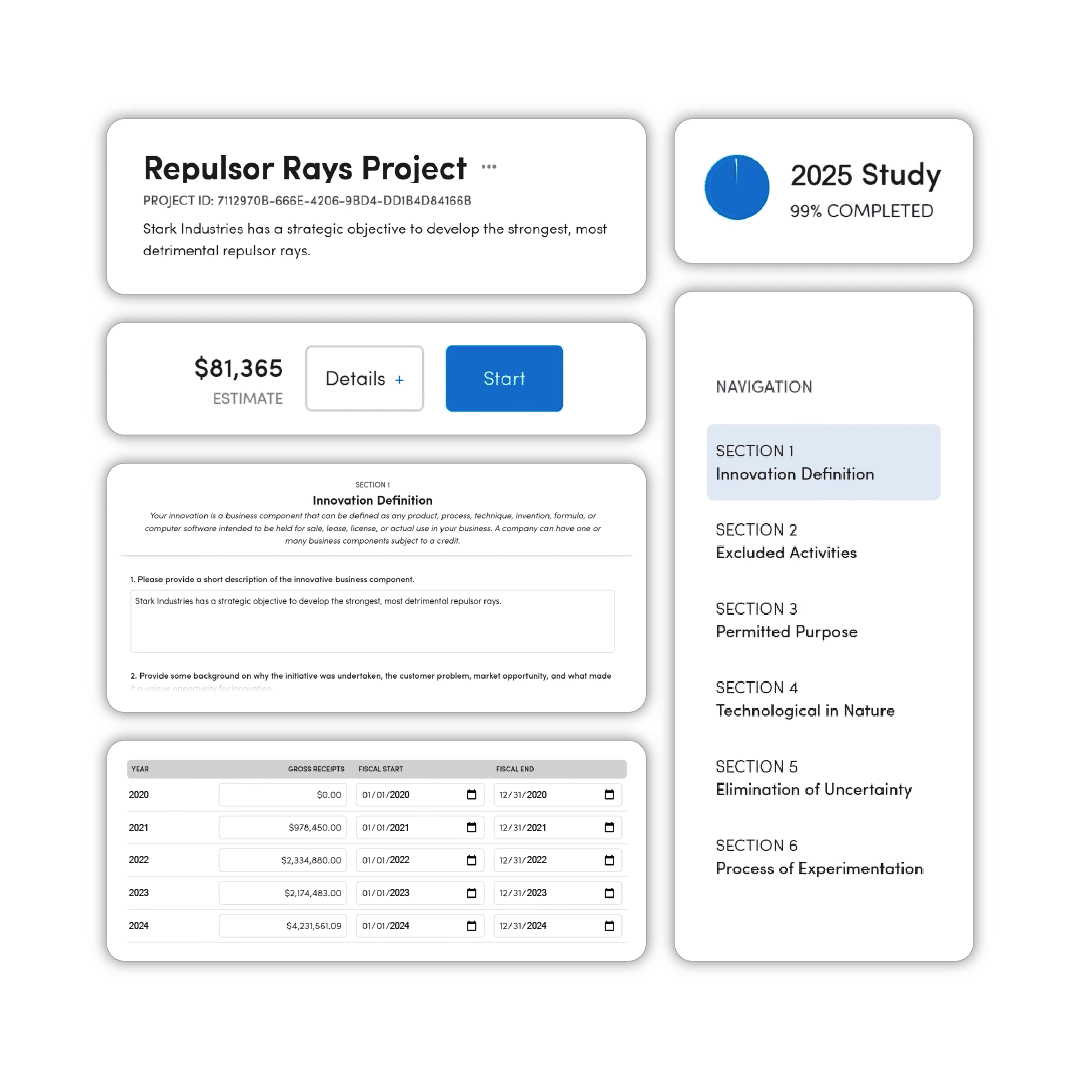

Research and Development Tax Credits

Claiming R&D tax credits can be complex, causing companies to abandon thousands in potential cash back. Arvo’s innovative platform integrates with your existing financial data to automatically identify qualifying projects and expenses. We streamline documentation and maximize your claim, turning your everyday innovation into significant capital.

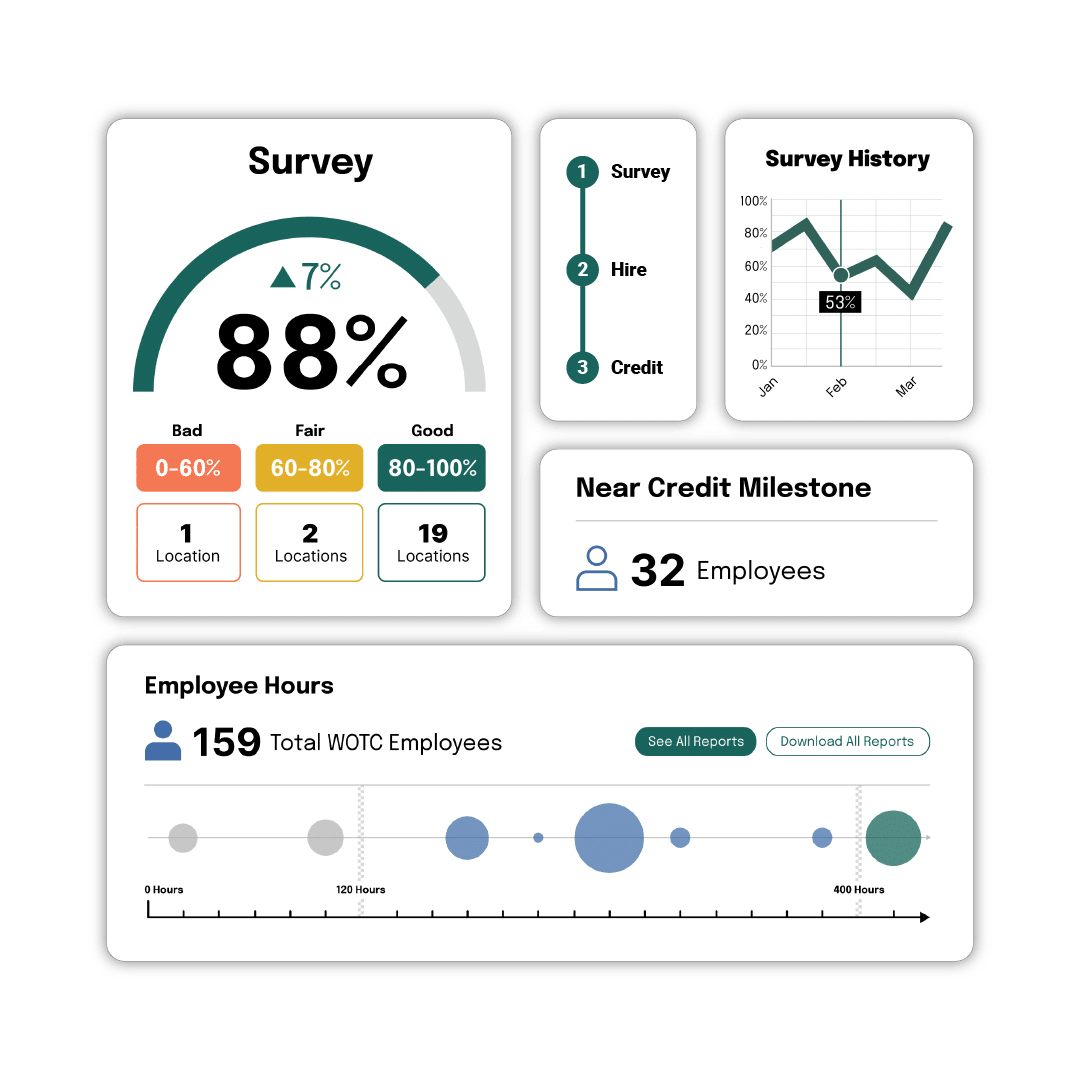

Work Opportunity Tax Credits

The Work Opportunity Tax credit rewards businesses for hiring disadvantaged job seekers, but the required process for claiming it can sometimes negate its value. Arvo seamlessly integrates into your onboarding process, automatically screening every new employee and filing the necessary forms on time. You’ll effortlessly capture thousands in tax credits for hires you already made.

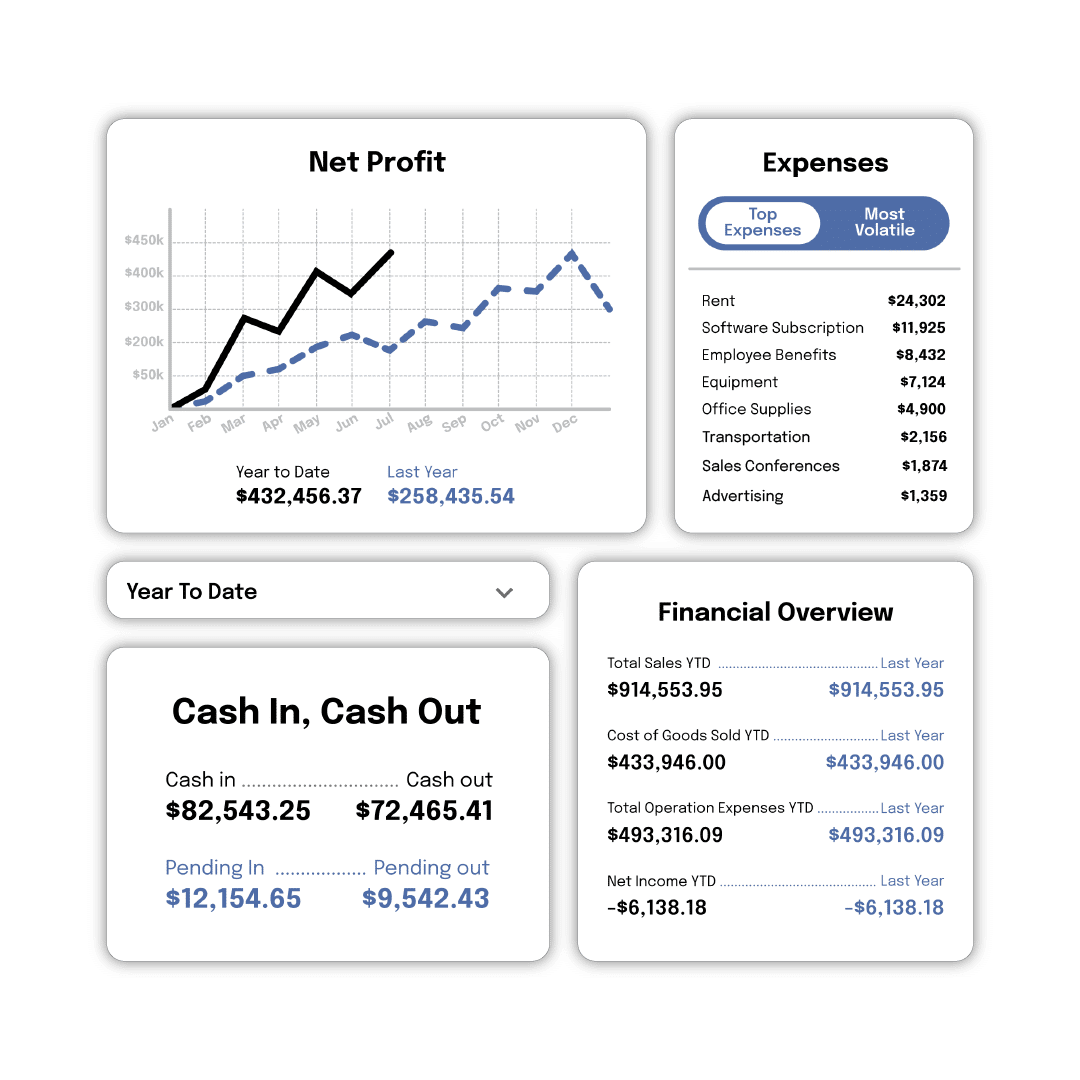

Better bookkeeping

Slow, reactive bookkeeping leaves you making critical decisions with outdated information. Arvo delivers accurate financials on time, every time. Stop looking backward and gain the instant financial clarity you need to confidently drive your company’s growth forward.

Research and Development

Turn your investments in innovation and development into a significant cash refund. Many of your company’s everyday activities likely qualify.

Work Opportunity Tax Credit

Get thousands back on federal taxes for hiring and retaining disadvantaged job seekers.

“The team at Arvo go above and beyond for our team at Barton Staffing to provide us with weekly reporting along with real-time data to make sure we are capitalizing on each and every opportunity. Arvo Tech is more than a vendor; they are a partner.”

“Take the time to sit down and talk with the Arvo team. It’s worth your time. Within 5 minutes you will say yes.”

“The team was super responsive to our request, timeline, and various questions. We made the decision to pursue the credit pretty late in the game to meet our tax deadline and they really supported us on the effort. All wins in our book.”

“Our experience with the Arvo team was outstanding! We were not familiar with the R&D credit and felt the process would be cumbersome. The Arvo team was really knowledgeable, very responsive, and solutions-oriented.”

“To be honest, I figured claiming the R&D tax credit would be an awful process, kind of like going to the dentist. With Arvo understanding the program was streamlined, easy, and presented in very simple terms. The team did a great job of removing all the clutter; getting down to what mattered most, and walking us through the process.”

“We had done R&D studies with another company that just took way too much employee and management time. And they were very expensive. Then I found Arvo. And it was an entirely different story. Clear directions. Easy software. Helpful people. Reasonable fees.”

Aunt Flow saved thousands by filling out one form

Tampon start-up saved taxes for developing socially-conscious product dispenser

Weekly live R&D tax credit webinars

Learn how to take advantage of historic 2025 R&D tax breaks

How can we help you?

Join over 5,000 businesses that have trusted their finances with Arvo